很多朋友问我,我回测中的历史杠杆ETF的数据是怎么来的,今天我就告诉大家如何根据股票历史价格计算出相应的杠杆ETF价格。

杠杆ETF运行机制

首先我们得明白杠杆ETF的运行机制,杠杆ETF每天结算,每天的涨跌幅等于没有杠杆的涨幅或者跌幅乘以杠杆比例,然后还要扣除ETF管理费用。

计算变化率函数

我们先写一个函数计算原始股票价格每天的变化率。

def _compute_change_ratio(previous_value: float,

current_value: float

):

change_ratio = current_value / previous_value

return change_ratio杠杆ETF价格变化函数

接下来,我们需要编写一个函数来计算杠杆ETF的价格变化。考虑到管理费用,我们还需引入一个修正值。

def _compute_leveraged_change_ratio(previous_value: float,

current_value: float,

leverage: int,

correction_rate: float):

change_ratio = _compute_change_ratio(previous_value, current_value)

leveraged_changed_ratio = (1 + (change_ratio - 1) * leverage) * correction_rate

return leveraged_changed_ratio计算开盘价的杠杆ETF价格

我们先写一个初始版本,只计算带杠杆的开盘价,给3个初始变量:

- 杠杆比例leverage=2

- 每日价格修正值先设为1(daily_correction_rate=1),也就是不修正

- 杠杆ETF第一天的股价设为1(init_value=1),这个值等于多少无所谓。,并展示其效果。

def main():

prices = get_prices("^NDX")

leverage = 2

daily_correction_rate = 1 ** (1 / 252)

init_value = 1

leveraged_opens = [init_value]

for price_id in range(1, len(prices)):

leveraged_change_ratio_open = _compute_leveraged_change_ratio(

prices.iloc[price_id - 1]["Open"],

prices.iloc[price_id]["Open"],

leverage,

daily_correction_rate)

new_leveraged_open = leveraged_opens[-1] * leveraged_change_ratio_open

leveraged_opens.append(new_leveraged_open)

leveraged_prices = DataFrame({"Open": leveraged_opens,

"Close": leveraged_opens,

"High": leveraged_opens,

"Low": leveraged_opens,

'Adj Close': leveraged_opens}, index=prices.index)

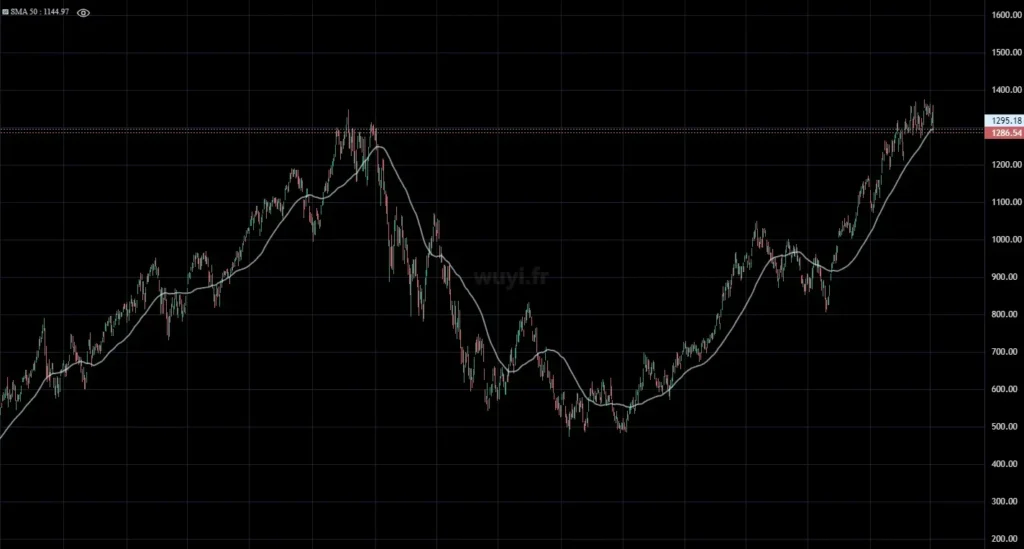

plot_in_chart(leveraged_prices, 50)

if __name__ == '__main__':

main()计算全部价格并封装函数

接下来,我们将补充收盘价、最高价和最低价的计算,并将代码封装成一个函数。

PS:这里我加入了函数变量的type信息(DataFrame,int,float),这在Python中不是必须的,但是加入变量内容信息更容易维护代码。

def compute_leveraged_prices(prices: DataFrame,

leverage: int,

init_value: float,

daily_correction_rate: float = 1):

leveraged_opens = [init_value]

leveraged_closes = [init_value * _compute_leveraged_change_ratio(

prices.iloc[0]["Open"],

prices.iloc[0]["Close"],

leverage)]

leveraged_highs = [init_value * _compute_leveraged_change_ratio(

prices.iloc[0]["Open"],

prices.iloc[0]["High"],

leverage)]

leveraged_lows = [init_value * _compute_leveraged_change_ratio(

prices.iloc[0]["Open"],

prices.iloc[0]["Low"],

leverage)]

for price_id in range(1, len(prices)):

leveraged_change_ratio_open = _compute_leveraged_change_ratio(

prices.iloc[price_id - 1]["Open"],

prices.iloc[price_id]["Open"],

leverage,

daily_correction_rate)

new_leveraged_open = leveraged_opens[-1] * leveraged_change_ratio_open

leveraged_opens.append(new_leveraged_open)

leveraged_closes.append(new_leveraged_open * _compute_leveraged_change_ratio(

prices.iloc[price_id]["Open"],

prices.iloc[price_id]["Close"],

leverage))

leveraged_highs.append(new_leveraged_open * _compute_leveraged_change_ratio(

prices.iloc[price_id]["Open"],

prices.iloc[price_id]["High"],

leverage))

leveraged_lows.append(new_leveraged_open * _compute_leveraged_change_ratio(

prices.iloc[price_id]["Open"],

prices.iloc[price_id]["Low"],

leverage))

leveraged_prices = DataFrame({"Open": leveraged_opens,

"Close": leveraged_closes,

"High": leveraged_highs,

"Low": leveraged_lows,

'Adj Close': leveraged_closes}, index=prices.index)

return leveraged_prices改进并调试

我们可以根据实际情况调整管理费用等参数,使得计算结果更加准确。

我们可以使用QLD官方给出的的年化0.95%的管理费作为参考,按照一年252个交易日计算,每个交易日的损失率就是(1-0.0095)**(1/252),修正比率也就是1-0.0095**(1/252),最后的代码变成这样。我们也可以把这里的函数全部放到别的py文件中,比如我们在前几节中建的utils.py。

# main.py

from pandas import DataFrame

from utils import get_prices, plot_in_chart

def _compute_change_ratio(previous_value: float,

current_value: float

):

change_ratio = current_value / previous_value

return change_ratio

def _compute_leveraged_change_ratio(previous_value: float,

current_value: float,

leverage: int,

correction_rate: float = 1):

change_ratio = _compute_change_ratio(previous_value, current_value)

leveraged_changed_ratio = (1 + (change_ratio - 1) * leverage) * correction_rate

return leveraged_changed_ratio

def compute_leveraged_prices(prices: DataFrame,

leverage: int,

init_value: float,

daily_correction_rate: float = 1):

leveraged_opens = [init_value]

leveraged_closes = [init_value * _compute_leveraged_change_ratio(

prices.iloc[0]["Open"],

prices.iloc[0]["Close"],

leverage)]

leveraged_highs = [init_value * _compute_leveraged_change_ratio(

prices.iloc[0]["Open"],

prices.iloc[0]["High"],

leverage)]

leveraged_lows = [init_value * _compute_leveraged_change_ratio(

prices.iloc[0]["Open"],

prices.iloc[0]["Low"],

leverage)]

for price_id in range(1, len(prices)):

leveraged_change_ratio_open = _compute_leveraged_change_ratio(

prices.iloc[price_id - 1]["Open"],

prices.iloc[price_id]["Open"],

leverage,

daily_correction_rate)

new_leveraged_open = leveraged_opens[-1] * leveraged_change_ratio_open

leveraged_opens.append(new_leveraged_open)

leveraged_closes.append(new_leveraged_open * _compute_leveraged_change_ratio(

prices.iloc[price_id]["Open"],

prices.iloc[price_id]["Close"],

leverage))

leveraged_highs.append(new_leveraged_open * _compute_leveraged_change_ratio(

prices.iloc[price_id]["Open"],

prices.iloc[price_id]["High"],

leverage))

leveraged_lows.append(new_leveraged_open * _compute_leveraged_change_ratio(

prices.iloc[price_id]["Open"],

prices.iloc[price_id]["Low"],

leverage))

leveraged_prices = DataFrame({"Open": leveraged_opens,

"Close": leveraged_closes,

"High": leveraged_highs,

"Low": leveraged_lows,

'Adj Close': leveraged_closes}, index=prices.index)

return leveraged_prices

def main():

prices = get_prices("^NDX")

leveraged_prices = compute_leveraged_prices(prices,

2,

1,

(1-0.0095)**(1/252))

plot_in_chart(leveraged_prices, 50)

if __name__ == '__main__':

main()

# utils.py

import warnings

import pandas as pd

import yfinance as yf

from lightweight_charts import Chart

def get_prices(stock_symbol, interval="1d"):

# 1wk for 1 week, 1mo for 1 month

data = yf.download(stock_symbol, interval=interval)

return data

def get_moving_average(prices, window_size, mode="sma"):

if mode == "sma":

sma = prices['Adj Close'].rolling(window=window_size).mean()

return sma

elif mode == "ema":

ema = prices['Adj Close'].emw(span=window_size).mean()

return ema

else:

warnings.warn(f"{mode} is not a known mode!!")

def plot_in_chart(prices, ma_windows_size, ma_mode="sma"):

chart = Chart()

chart.set(prices)

chart.legend(visible=True)

column_name = f'{ma_mode} {ma_windows_size}'.upper()

line = chart.create_line(column_name)

sma = pd.DataFrame({"Date": prices.index,

column_name: get_moving_average(prices, ma_windows_size, ma_mode)})

line.set(sma)

chart.show(block=True)

最终得到的结果可以与QLD的实际价格进行对比,进行微调以使计算结果更加准确。同时,也可以根据需求自行计算不同杠杆倍数的ETF价格,根据我的经验,杠杆倍数越高,修正值越小,损耗也越严重,这也是为什么杠杆ETF长期持有风险大的原因。

保存导出数据

当然,你也可以选择把计算出来的数据保存下来,这也很简单

leveraged_prices.to_csv("your_path.csv")

两个星号评论发不出来,变成加粗了 **

谢谢提醒,网站还有不少技术问题需要解决😂

每个交易日的损失率就是(1-0.0095)^(1/252),这句话没太理解,每个交易日损失率应该是0.0095^(1/252)吧?

我用的算法是(1-0.0095)^(1/252),一年的损耗是0.0095,也就是说1块钱一年后变成1*(1-0.0095)=0.9905。0.9905的(1/252)次方表示按照复利计算,一年252天每天剩下的比率:(1-0.0095)^(1/252)=0.999962122094991,也就是说每天损失大约0.0000378。

你说的按照0.0095/252其实在指数因子非常小的时候是可以用作等价估算的,用你的算法,1-0.0095/252 = 0.9999623015873016 跟我算出来的0.999962122094991差别非常小。

其实用你的方法就可以,可能更好理解一些